how much is renters credit on taxes

Based on rent paid in 2016 and 2016 incomes 324840 renters received refunds. If you own use your Property Tax Statement.

Here Are The States That Provide A Renter S Tax Credit Rent Blog

120 credit if your are.

. There are specific requirements that are standard in all states that offer renters tax. RENTERS WILL BE able to apply for a new tax credit worth 500 per year. Renters who are not required to pay their owners property.

If at least one member of your household is 65 or older the credit can be as much as 375. For additional information see. The measure was announced today as part of Budget 2023.

One area of relief they have provided is a credit that allows renters 50 per exemption for those that qualify. 15 2022 and you can file online. If rent constituting property taxes exceeds a threshold percentage of income the refund equals a.

You can get it. 60 credit if you are. The property tax relief a renter may receive is based upon a comparison of the assumed real property tax in the yearly rent minus a percentage of the household income as.

If your credit is more than the taxes you owe you can claim a refund. There is a cap on this amount however. Individuals Renter Credit Renter.

Rent constituting property taxes is assumed to equal 17 percent of rent paid. The federal government will immediately take 80568000 from that cash option 24 leaving you 335619432. The amount of the Michigan Homestead Property Tax Credit is equal to the amount of property taxes that owners or renters pay.

As with other tax credits it will be set against your other liabilities and credits so you might not necessarily get a cheque in the post for 500. You or your spouseRDP were not given a property tax exemption during the tax year. Up to 500 per calendar year.

Massachusetts MA offers a credit to renters for up to 50 of your rent paid up to 3000 1500 per return if married filing separately as long as the rental property is your. Use the calculator to estimate your Renter Credit. The new limits are 50 of.

But they must have a household income of less than 24680 to qualify for the credit. 2021 Renter Credit Website Calculator_8xlsx 5044 KB File Format. To see if youre eligible first find your gross household.

Remember the rest of your federal tax bill comes next year. The 500 per year relief has been backdated to 2022 so renters can apply for a double tax credit worth 1000 at the end of this year. Get the tax form called the 2021 Form M-1PR Homestead Credit Refund for Homeowners and Renter Property Tax Refund.

The average refund was 653 and the total dollar amount of refunds paid statewide was 2121. AN ANNOUNCEMENT BY government that the 2023 budget will include a 500 tax credit for renters was undercut by a press release from the housing charity Threshold who. In those states the tax credit tends to be a negligible amount often 60 or 75 in total.

The income limits for the program are much different than they used to be. Renters Tax Credit Applications for 2022 will be available for Maryland tenants on Feb. Typically the deduction limit is set at 50 percent of the rent paid throughout the given tax year.

Previously the income limit was 47000 regardless of your family size or where you lived. The advice given on this page is meant as a general guide only and. Taxpayers cannot deduct residential rent payments on your federal income.

Here Are The States That Provide A Renter S Tax Credit Rent Blog

.png?sfvrsn=93f9375b_4&MaxWidth=350&MaxHeight=500&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=5D523F1E6BBDE462F36757D97CD03FF66652E954)

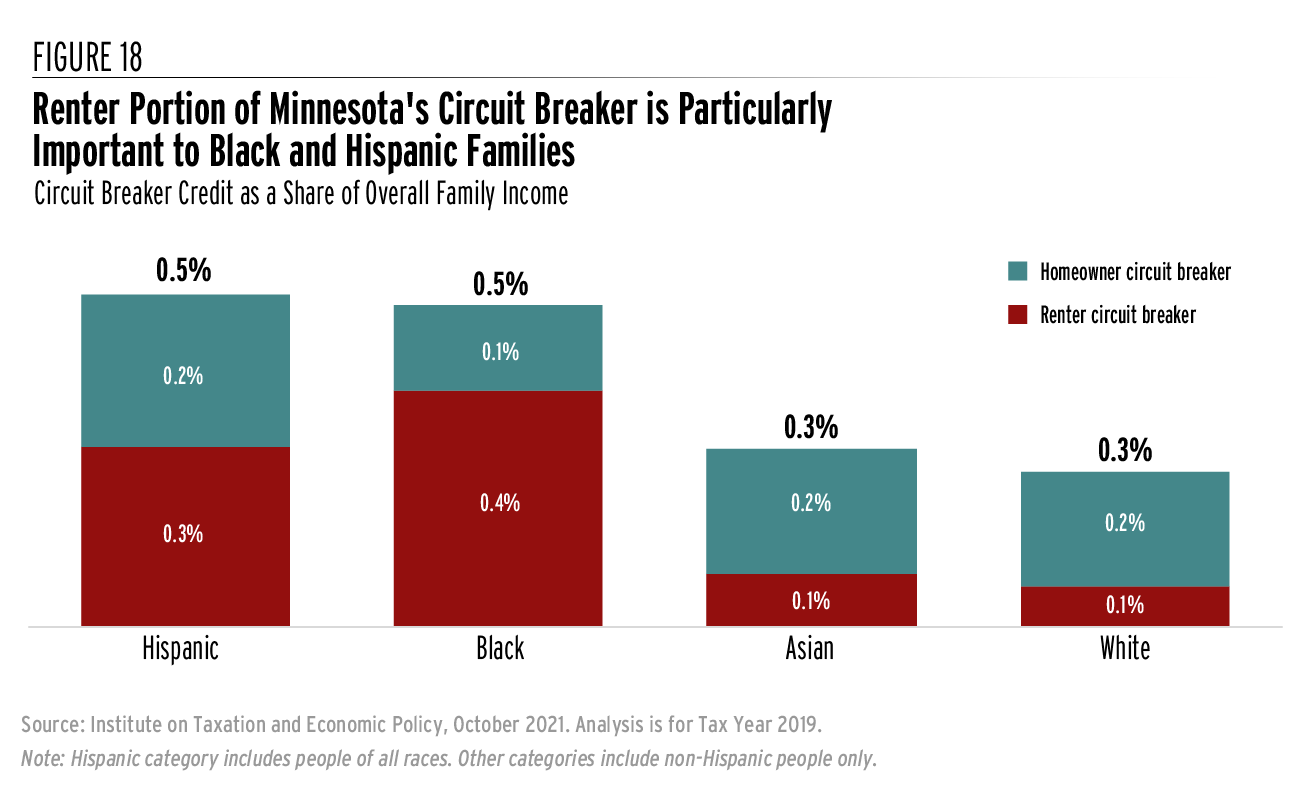

Protecting And Strengthening Minnesota S Renters Credit

Ihcda Rental Housing Tax Credits Rhtc

Increasing Property Taxes And Falling Rent What Can Landlords Do Avail

Don T Miss Out On This Money The Property Tax Credit And The Renter Credit Renter Rebate Vtlawhelp Org

Credit Karma Tax Vs Turbotax Which Is Better For Filing Taxes

California Bill Would Boost Renter Tax Credit For First Time In 40 Years Kqed

Property Tax Credits Are You Eligible City Of Takoma Park

Renters 7 Tax Deductions Credits You May Qualify For The Official Blog Of Taxslayer

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Rental Property Tax Deductions Property Tax Deduction

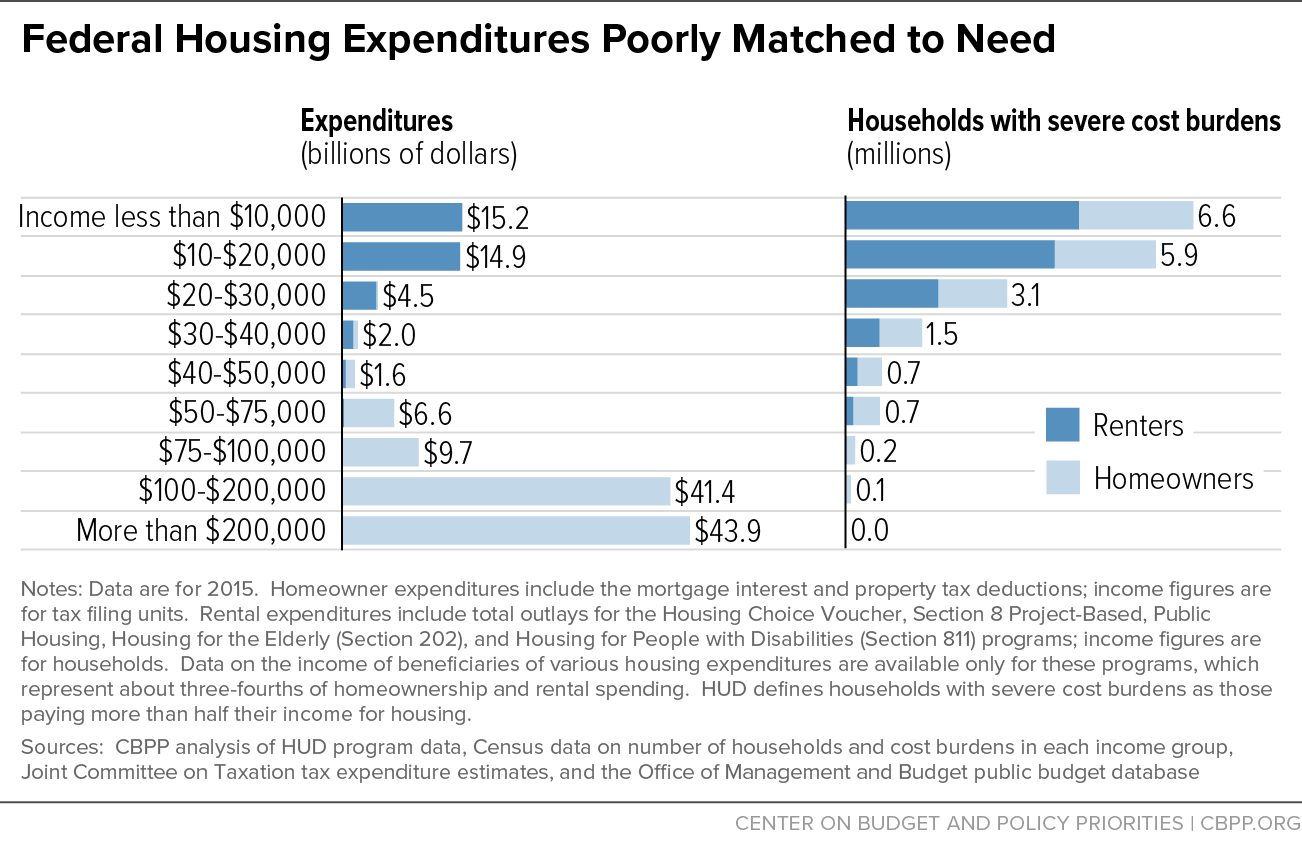

Renters Credit Would Help Low Wage Workers Seniors And People With Disabilities Afford Housing Center On Budget And Policy Priorities

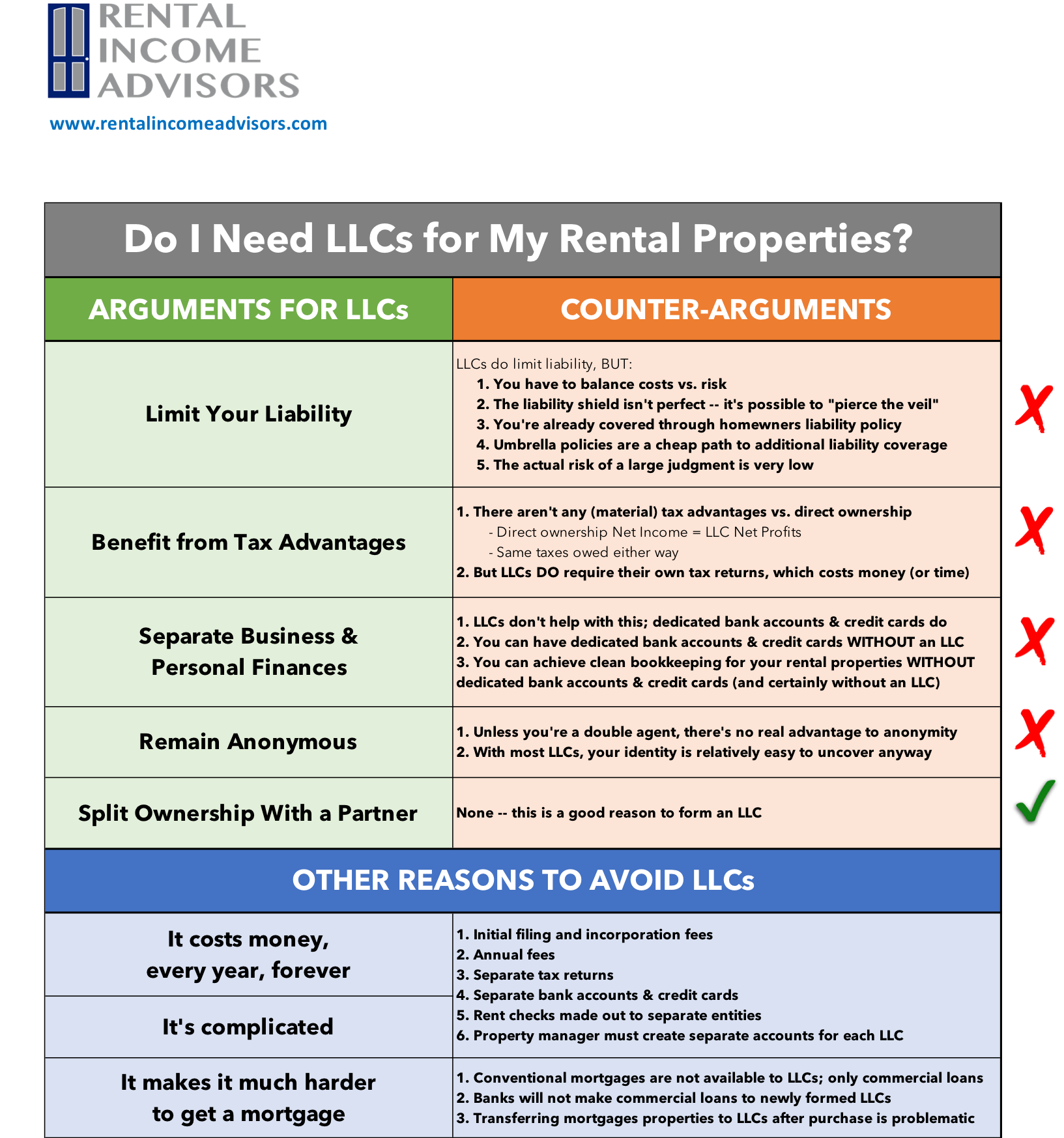

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

Education Tax Credits For College Students The Official Blog Of Taxslayer

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Renting My House While Living Abroad Us And Expat Taxes

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com