who pays sales tax when selling a car privately in illinois

Form ST-556 Sales Tax Transaction. Who pays sales tax when selling a car privately in Illinois.

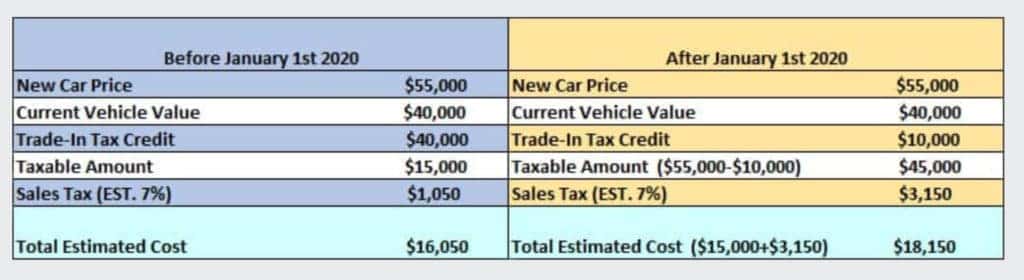

Illinois Car Trade In Tax Changes Starting January 2020 Honda City Chicago

This tax is paid directly to the Illinois Department.

. Use the illinois tax rate finder to find your tax. Although the buyer pays for this inspection the seller and buyer must agree on when and where the inspection is to be held. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

There is also between a 025 and 075 when it. Illinois Sales Tax on Car Purchases. REPLACEMENT VEHICLE TAX If you are a selling dealer in Illinois and the.

If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. In addition to state and county tax the City of.

It starts at 390 for. For vehicles worth less than 15000 the tax is based on the age of the vehicle. Safety Administrations NHTSA odometer disclosure.

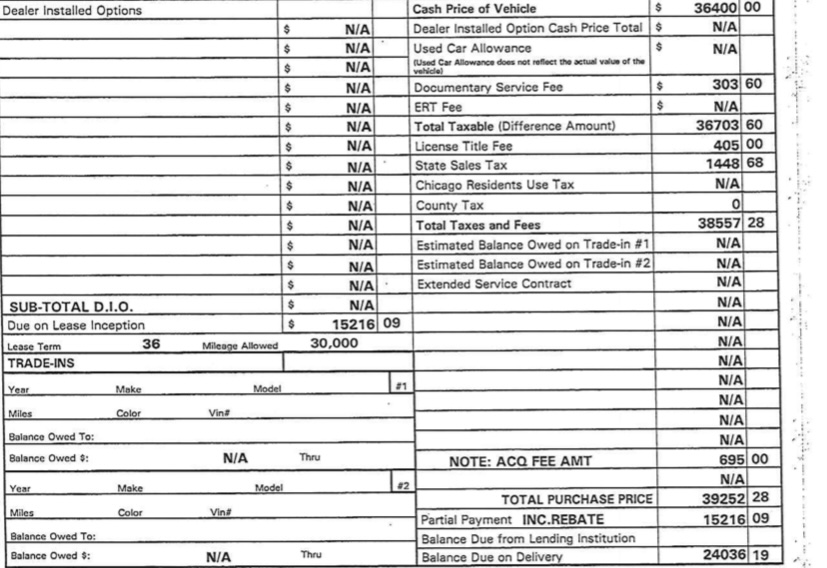

There is also between a 025 and 075 when it comes to county tax. How is sales tax calculated on a used car in Illinois. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

Who Pays Sales Tax When Selling a Car Privately in Illinois 19 april 2022 MogulSkier2016. There is also between a 025 and 075 when it comes to. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

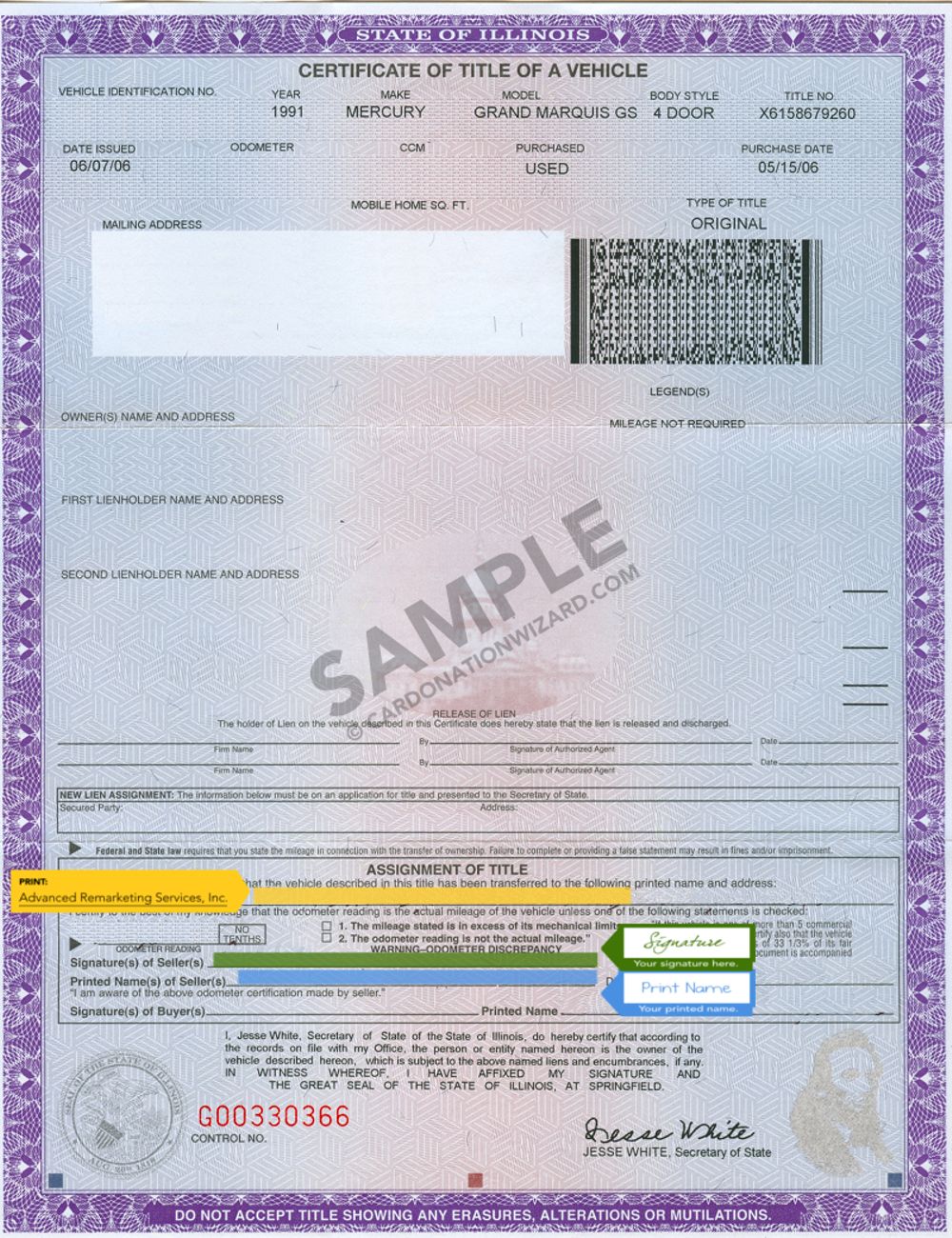

Who pays sales tax when selling a car privately in illinois. Form RUT-50 Private Party Vehicle Use Tax Transaction Return due no later than 30 days after the purchase date of the vehicle. WHEN SELLING YOUR CAR Reporting a wrong purchase price is FRAUD.

Therefore your car sales tax will be based on the 25000 amount. For vehicles worth less than. You will subtract the trade-in value by the purchase price and get 25000.

When you sell your car you must declare the actual selling purchase price. As of January 1st 2022. If you are selling a car in illinois you must follow the following steps.

Saying a SALE is a GIFT is FRAUD.

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

How Much Does It Cost To Transfer A Car Title In Illinois

Illinois Sales Use Tax Guide Avalara

How To Sign Your Illinois Title Transfer In 3 Steps Youtube

What To Know About Taxes When You Sell A Vehicle Carvana Blog

2020 Illinois Trade In Sales Tax Law Change Land Rover Hinsdale

Free Tennessee Bill Of Sale Form Pdf Word Legaltemplates

Texas Used Car Sales Tax And Fees

How Do I Sell My Car Illinois Legal Aid Online

8 Tips For Buying A Car Out Of State Carfax

What Is The Sales Tax On A Car In Illinois Naperville

Understanding California S Sales Tax

Illinois Title Transfer Buyer Instructions Youtube

License Title Tax Info For New Cars Chicago Il Marino Cjdr

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

Buying From A Private Seller Vehicle Registration Titling And Fees Explained